Elder Counselor Volume 6 Issue 5

November 2015

Most Americans are unaware or in denial of their potential need for long-term care and the costs associated with it. This is supported by many studies and was reconfirmed recently in a telephone survey of 1,735 Americans over the age of 40, funded by the SCAN Foundation and conducted by the Associated Press – NORC Center for Public Affairs Research. This survey highlights many Americans’ lack of preparedness for long-term care needs. It demonstrates widespread unawareness of the positive impact of “person-centered care” practices; uncertainty about which long-term care services are covered by Medicare, Medicaid, and private insurance; and increasing disregard for planning to manage the costs and caregiving needs associated with long-term care.

As professionals who serve the elderly are well aware, planning ahead for long-term care makes an enormous difference in the overall well-being of not just elders themselves but also their family members. By facing the facts and establishing a solid plan to cover the financial and care challenges of aging, older adults can position themselves to maintain maximum independence for as long as possible while relieving the caregiving burden on their families.

Who Will Need Long-Term Care

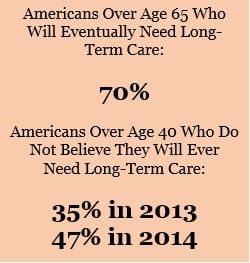

According to the Genworth Cost of Care Survey of 2015, 70 percent of Americans over the age of 65 will eventually need some type of long-term care services and support. Yet the AP-NORC survey shows an increasing number of people over the age of 40 refusing to believe they will ever need long-term care. About 47 percent of adults over age 40 do not recognize the likelihood that one day they will need ongoing living assistance. In 2013, only 35 percent of the same demographic thought they would not need long-term care. Because so many middle-aged and older adults do not grasp the high probability that they will eventually need long-term care services, the financial burden on society – public benefits programs, family caregivers, and the older adults themselves – is likely to increase. Failure to plan ahead before a crisis arises puts aging adults and their families in difficult and sometimes dangerous medical, emotional, and financial situations.

According to the Genworth Cost of Care Survey of 2015, 70 percent of Americans over the age of 65 will eventually need some type of long-term care services and support. Yet the AP-NORC survey shows an increasing number of people over the age of 40 refusing to believe they will ever need long-term care. About 47 percent of adults over age 40 do not recognize the likelihood that one day they will need ongoing living assistance. In 2013, only 35 percent of the same demographic thought they would not need long-term care. Because so many middle-aged and older adults do not grasp the high probability that they will eventually need long-term care services, the financial burden on society – public benefits programs, family caregivers, and the older adults themselves – is likely to increase. Failure to plan ahead before a crisis arises puts aging adults and their families in difficult and sometimes dangerous medical, emotional, and financial situations.

Providing Hands-on Long-Term Care

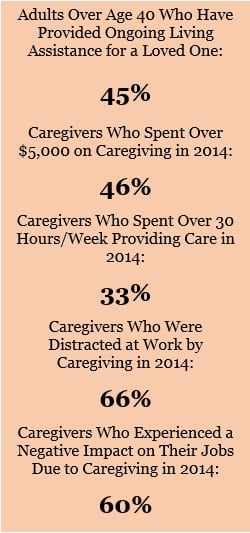

Family caregivers surveyed in 2014 on Caring.com report investing significant amounts of time and money in helping to care for a loved one. Forty-six percent spent more than $5,000 per year on caregiving costs. Beyond the financial burden, these family caregivers experienced significant disruptions to their daily lives: 33 percent spent more than 30 hours per week providing care; 66 percent were distracted during work by phone calls or e-mails related to caregiving; and 60 percent experienced a negative impact on their jobs due to providing care for a loved one. According to the AP-NORC survey, 45 percent of adults over age 40 have at some point provided ongoing living assistance for a loved one. Of these, 19 percent are currently providing long-term care. About 47 percent of current caregivers are in the “sandwich generation” situation, simultaneously providing financial support to their children.

Family caregivers surveyed in 2014 on Caring.com report investing significant amounts of time and money in helping to care for a loved one. Forty-six percent spent more than $5,000 per year on caregiving costs. Beyond the financial burden, these family caregivers experienced significant disruptions to their daily lives: 33 percent spent more than 30 hours per week providing care; 66 percent were distracted during work by phone calls or e-mails related to caregiving; and 60 percent experienced a negative impact on their jobs due to providing care for a loved one. According to the AP-NORC survey, 45 percent of adults over age 40 have at some point provided ongoing living assistance for a loved one. Of these, 19 percent are currently providing long-term care. About 47 percent of current caregivers are in the “sandwich generation” situation, simultaneously providing financial support to their children.

Adults over 40 in the sandwich situation express deeper concern than others about aging-related issues. Fifty-four percent say that they are deeply concerned about being able to pay for needed long-term care (compared to 36 percent of other adults over 40); 44 percent say they are greatly worried about leaving debts to family (compared to 28 percent of others); and 50 percent express deep concern about leaving their homes to receive care in a facility (compared to 38 percent of others). However, despite witnessing the challenges of aging and experiencing the caregiver burden firsthand, this group is not significantly better than other adults at actually planning ahead or saving for these challenges so that the burdens on themselves or their children might be alleviated.

Coordinating Long-Term Care

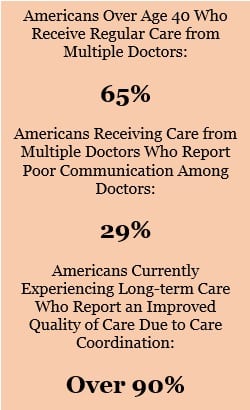

According to the AP-NORC survey, over 65 percent of adults over the age of 40 have two or more doctors that they see on a regular basis. 29 percent of these adults report that their health care providers do not communicate well or at all. One way of alleviating the problem of poor care communication is through person-centered care, which involves care coordination.

According to the AP-NORC survey, over 65 percent of adults over the age of 40 have two or more doctors that they see on a regular basis. 29 percent of these adults report that their health care providers do not communicate well or at all. One way of alleviating the problem of poor care communication is through person-centered care, which involves care coordination.

The survey defines person-centered care as “an approach to health care and supportive services that allows individuals to take control of their own care by specifying preferences and outlining goals that will improve their quality of life.” While person-centered care may take many different forms, according to the survey, a central tenet of person-centered care is care coordination across multiple health care providers. Coordinated care helps to reduce overlap in medical care, misdiagnosis, or other medical oversights.

Not all aging adults have had the opportunity to experience a care coordinated approach, and many do not recognize the potential benefits of this approach. The survey shows that 27 percent of those who are currently experiencing long-term care but who have never received care coordination are doubtful about its positive effects. However, more than 90 percent of those currently receiving coordinated long-term care acknowledge an improved quality of care. Care coordination truly does improve the overall quality of care for older adults.

Financing Long-Term Care

One of the questions many people fail to ask until they are mid-crisis is “How will we pay for long-term care?” Since they have never asked themselves this question, many older Americans do not know the correct answer when the time comes to explore their options. The AP-NORC survey shows that many people do not understand which services are (and are not) covered by Medicare, Medicaid, and private health insurance.

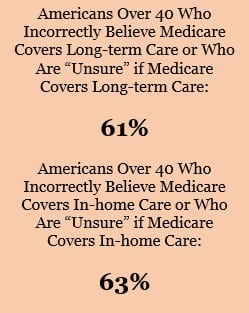

Of those surveyed, 34 percent believed that Medicare would pay for long-term care and 27 percent were “unsure” if Medicare would cover long-term care. Thirty-six percent of respondents thought Medicare would cover care in the home, and 27 percent were “unsure.” The truth is that Medicare does not pay for ongoing long-term care (although it will pay for intermittent stays at nursing facilities). Furthermore, Medicare doesn’t typically pay for care in the home.

Of those surveyed, 34 percent believed that Medicare would pay for long-term care and 27 percent were “unsure” if Medicare would cover long-term care. Thirty-six percent of respondents thought Medicare would cover care in the home, and 27 percent were “unsure.” The truth is that Medicare does not pay for ongoing long-term care (although it will pay for intermittent stays at nursing facilities). Furthermore, Medicare doesn’t typically pay for care in the home.

As for private insurance, most health insurance plans will not cover long-term services like a nursing home or ongoing care provided at home by a licensed home health care aide. Yet 18 percent of Americans age 40 and older believe that their insurance will cover the costs of ongoing nursing home care, while 25 percent believe their plan will pay for ongoing care at home. About 1 in 5 people surveyed were unsure of the coverage provided for these types of long-term care services.

Medicaid is the country’s largest payer of long-term care services. In 2013, Medicaid paid for 51 percent of the national long-term care bill totaling $310 billion. However, 51 percent of Americans age 40 and older reported that they don’t expect to have to rely on Medicaid to help pay for their ongoing living assistance expenses as they age.

The actual costs for long-term care are staggering. Genworth reports that, nationwide, the average annual cost per person for residence in a nursing home is approximately $80,300, the average annual cost per person for residence in an assisted living facility is $43,200, and the average annual cost per person for in-home care is approximately $44,616. In Tennessee the average annual per-person cost of care is slightly lower but still substantial: $70,080 for nursing home residence, $40,740 for assisted living residence, and $40,704 for in-home care. Planning well in advance for how to pay for these services is essential to ensure that older adults get the care they need without impoverishing themselves or becoming a burden on their families.

Reluctance to Plan for Long-Term Care

Most Americans are unprepared for the costs associated with long-term care. For example, the AP-NORC survey reveals that only one-third of adults are “very or extremely confident” in their ability to pay for long-term care. While many individuals report concern over leaving family with debt or becoming a burden on loved ones, many do little to alleviate their concern in the way of planning. In fact, just over 30 percent of those over the age of 65 report being concerned with planning ahead for long-term care. Furthermore, 55 percent of Americans over the age of 40 report doing little or no planning for their own long-term care.

Most Americans are unprepared for the costs associated with long-term care. For example, the AP-NORC survey reveals that only one-third of adults are “very or extremely confident” in their ability to pay for long-term care. While many individuals report concern over leaving family with debt or becoming a burden on loved ones, many do little to alleviate their concern in the way of planning. In fact, just over 30 percent of those over the age of 65 report being concerned with planning ahead for long-term care. Furthermore, 55 percent of Americans over the age of 40 report doing little or no planning for their own long-term care.

The good news is that the number of adults over 40 who report planning ahead for aging issues has increased since 2013, from 32 to 45 percent. Still, for more than half of adults over age 40 to neglect planning for long-term care is no small matter.

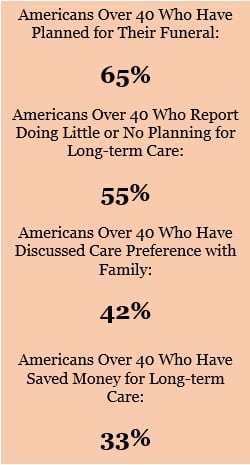

The survey results lead to the conclusion that many Americans are reluctant to face and plan for the possible loss of independence related to aging. Americans are evidently even more comfortable thinking and talking about their own deaths or how they wish to be memorialized than they are with thinking or planning for long-term dependence on others. While nearly 65 percent of respondents had planned for or talked to loved ones about their funeral arrangements, only 42 percent had discussed care preferences with family and only 33 percent had saved money for long-term care. Americans place a high value on independence. For many older adults, one of the most uncomfortable and even frightening realities is that they may not be able to maintain that independence for the duration of their lives.

Conclusion

Although not a popular topic among Americans over the age of forty, planning for long-term care is an increasingly important issue. There are many myths and misconceptions associated with who will need long-term services and support, who will provide and pay for that care, and how costly it is likely to be. By planning well in advance, aging adults can spare themselves and their families a great deal of emotional and financial turmoil and protect what is most valuable to them.

Elder Law of East Tennessee is in the business of helping individuals and families prepare for their potential long-term care needs. If you, a loved one, or a client needs help learning what options are available and navigating the decision-making process, please think of us. We can help and are always happy to hear from you.