What Assets Can a Spouse Keep with TennCare?

When applying for TennCare CHOICES, Tennessee’s Medicaid program that covers long-term services and supports, there are certain assets that are exempt assets. Exempt assets don’t count against the applicant when determining if they meet the program’s asset limits. Currently, those excluded assets include the homestead and any contiguous property (up to a certain equity value), one vehicle, term life insurance, a prepaid burial and funeral, and cemetery plots, to name a few.

Spousal Protections Under TennCare

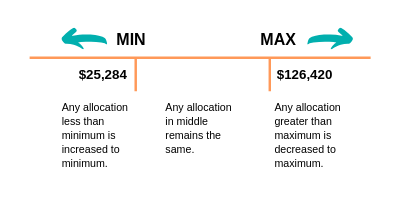

TennCare rules account for the fact that many applicants are married, and their spouses may not need long-term care in a residential facility. It is important that the community spouse be able to keep sufficient resources to pay for living expenses in the community. If the applicant is married, his or her spouse is able to keep one-half of the marital countable assets that range between $25,284 and $126,420*.

The exact number that a spouse can keep is determined through looking at both spouses’ assets at a certain point in time, dividing that figure in half, and then awarding that amount to the spouse who is not applying for benefits, as long as it is between those figures. It does not matter which spouse’s name an asset is in; because they are married, they are assumed to have equal access to all assets, and therefore all countable assets in either name are included in the calculation. If the total assets are less than $25,284, then the spouse of the applicant gets to keep $25,284 of their collective assets. If the total assets (when divided in half) are more than $126,420, the spouse is limited to that number. What remains is called the “spend down” amount.

Spousal Allocations

A community spouse may also be entitled to keep some of their applicant spouse’s income under what is called a “spousal allocation.” A person receiving benefits is required to contribute some of his or her income to pay for care. This is called the “patient liability.” The federal government has established a minimum amount that a community spouse must make to remain out of poverty. For 2019, this number is $2,030*. In limited circumstances, it is possible to get a higher amount if the community spouse has exceptionally high living expenses. This reduces the amount of the patient liability the couple has to pay for the applicant’s care.

Confused? The Medicaid and TennCare programs are not straightforward, and it may take a professional to cut through all the rules and calculations and help you understand the bottom line. You can seek help from a qualified elder law attorney experienced in Medicaid applications to guide you through the process and make sure you don’t give up more of your assets than the program requires.

*TennCare and Medicaid figures and calculations are subject to change over time. This amount represents the calculation for year 2019. When determining eligibility and calculating penalty periods, always make sure you are using the most recent TennCare/Medicaid standards.